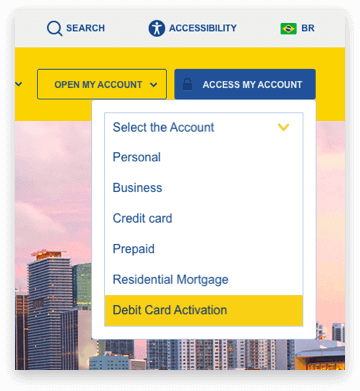

1 – Access our website, click on Login and select Enroll now.

2 – Fill out all the fields below and select “continue enrollment.”

- Tax ID (SSN or TIN or CPF): Foreign clients/ CPF holders must include only the first 9 digist of your foreign identification (CPF number). Example: if the CPF number is “123456789-03”, enter it as ´123456789`.

- Account type: Inform the type of account (Checking, Money Market, Savings).

- Account Number: Enter the account number, it should contain 10 digits.

- Date of Birth: Enter your date of birth in the following format MM-DD-AAAA.

3 – Create your username & password.

- Username: Your username must contain 6 to 30 characters in a row and no special characters. Choose a username that is unique and easy to remmber. Avoid using your ID information as in your driver´s license, CPF number and passport.

- Password: Your password must contain both lowercase and uppercase letter, and a special character (!@#$%¨&*). Choose a password that is unique and easy to remember. Avoid using your ID information as in your driver´s license, CPFnumber and passport.

4 – Confirm your password and your primary e-mail address. Then select “Continue enrollment”.

- Confirm password: Enter the password you created to confirm.

- Primary e-mail: Enter the e-mail registered to your account.

- Confirm Primary e-mail: Re-enter the email registered to your account and then confirm it.

5 – Review all your information, and click on “Continue enrollment”.

6 – The enrollment is completed.

7 – Read the terms and conditions of the bank. Once you have read and agreed with the terms and conditions please select the box next to “I have read and agree to the terms & conditions. Then select “Accept.”

8 – Congrats! Your enrollment was successful.